It can happen to anyone. In today’s digital world, identity theft is quite common. It is quite possible that you wake up one fine day and find someone else in some distant part of the world using your personal information or even stealing your identity and pretending to be you. You may even see them impersonating you in practically everything. That can perhaps be a huge nightmare. If you have found yourself becoming a victim of identity theft, you should instantly look for the right options to take the fraudulent person to task.

If you find your identity has been stolen, the first thing you need to do is to file a police report. Create and file an immediate report to the Federal Trade Commission (FTC). Next, check your credit reports and instantly freeze all your credits. Call up creditors and other businesses that you are dealing with and inform them that your identity is stolen.

What is Identity Theft?

Identity theft is when someone else uses your personal information without your permission. It is a crime wherein scammers and fraudsters impersonate you and commit some of the actions that would make you the actual face of the act. Most of the activities tend to be of a criminal nature and thus can result in damaging your name and personality.

Identity theft can include stealing a lot of information, including…

your name, address, credit card or bank account numbers, Social Security number, or medical insurance account numbers. The identity theft is used for the following activities…

- Opening new accounts in your name.

- Using existing accounts for fraudulent activities in your name

- Making purchases at your cost

- Availing medical services

- Getting new credit cards and

- undertaking other frauds.

How Can Identity Theft Happen?

Identity theft can result from a huge number of reasons. The most common possibility is the data breach. You may also find other means used to steal your identity; some of them include phishing, vishing, and smishing. A few other possibilities can consist of malware attacks and dark web activities. Identity theft can occur in several ways, which include in person, online, through social media, and by phone.

The primary means that identity theft can happen include

- Data breaches: Hackers may attack the websites and access their customer database. These details are then leaked onto the dark web. This will access to your email addresses and phone numbers to the scammers.

- Phishing attacks: Scammers impersonate themselves as an organization you trust and make you fall victim and part with your personal information. I was once contacted by a scammer who posed as a representative from the credit card company that I am using and told me that I was about to lose the rewards points that are accrued to my card. Since I regularly track and redeem my reward points, I could catch them easily.

- Device and network hacking: Hackers can use the public WiFi networks to steal the data transmitted over them. They may also hack individual phones and other devices to get the confidential information

- Malware and other viruses: Fraudsters may also trick you into downloading a malware that spies on your personal information.

- Physical theft: The scammers might have got access to physical documents and IDs. They can have access to practically everything – right from your driving license to your passport.

How Should You Respond To The Theft Of Your Identity?

When you are sure that your identity was stolen, stop panicking. Recognize your identity theft immediately and take immediate steps to help you minimize the effects.

1. Alert your bank and credit card companies immediately

Get in touch with the company, banks, and other organizations that you suspect that the identity theft has occurred. They will help you in freezing your cards or restricting your accounts. This will help in preventing any further transactions.

2. Freeze your credit cards

Most of the identity thefts are directed at the financial benefits. As soon as a scammer accesses your identity, the first thing they would do is to open new accounts or decide to take loans in your name. A credit freeze is the best option to help you prevent the further use of the credit in your name.

3. File an official report with the Federal Trade Commission (FTC)

If you want to prove that your identity was stolen and when you are disputing a fraudulent activity, you would invariably require a report. The complaint to the FTC will help you getting a proper recovery plan. This will help you in taking further actions to help you prevent other misuses of your identity

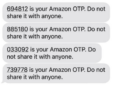

4. Change your passwords and enable two-factor authentication

Change the passwords for almost each of your accounts. The primary ones that you need to take care of would include banking, credit cards, and even the important social media profiles. Most of the online accounts today support two-factor authentication. Ensure that you have opted for the two-factor authentication wherever and whenever possible. Make sure you are using difficult passwords. If you are suspicious of forgetting the tough passwords, you can use reliable password managers.

5. File a report at the local law enforcement

Along with a complaint filed at the FTC, it may also be a good idea to file a complaint at the local law enforcement agency. This can include your local police station and any other competent authority. Make sure that you have received a copy of the complaint and keep it handy at all times. You can use this proof to dispute the fraudulent transactions.

6. Scan your device for malware

Malware and other device hacking tools can be very damaging. They can provide the hackers with the most sensitive information stored on your device – including the details of your online accounts and your passwords. Or even your financial information.

Download a genuine antivirus and malware detector on your device and scan your device for any malware or viruses. If you find any such tools installed, remove them instantly.

7. Replace stolen documents and IDs

If you know that scammers have stolen your important documents and IDs and may use them for the theft of identity, make sure to contact the relevant authorities to get them replaced. A few of the documents that would need attention would include a Social Security card, driver’s license, passport, medical card, and Health insurance card. Most of them can be reported for identity theft and be instantly replaced.

8. Sign up for an identity theft protection

You can opt for identity theft protectors. With such services, you can make sure that you can protect your identity. These services will take care to help you in taking care of Data breaches, the Dark Web, public records, and social media monitoring. They also undertake credit monitoring and help in real-time fraud alerts. They also provide you with identity theft insurance.

9. Contact IRS

Tax benefit theft is a type of fraud in which scammers can file taxes in your name. This is done to claim bogus income and get benefits. Get in touch with your Internal Revenue Service (IRS) to ensure that you have not fallen prey to tax identity theft.

10. Check for the occurrence of criminal identity theft

Scammers and fraudsters may also take up criminal activities in your name. You may thus be forced to pay for fines and other levies when you actually have nothing to do with it. Fighting criminal identity theft may be really difficult. Law enforcement agencies may continue to treat you as a criminal until you are able to prove your ignorance or innocence. In fact, this can also lead to social stigma and other complications, such as loss of a job in some extreme cases.

When you suspect any suspicious activity or unauthorized transactions in your accounts, place a fraud alert report with the relevant authorities. Now that courts publish records of the cases online check if your name appears in any of the cases.

What Are The Warning Signs Of Identity Theft?

The consequences of identity theft can be very risky. That is why it is highly essential to take care of identity thefts and the warning signs thereof.

Here are some of the signs of an ID theft:

Unfamiliar transactions

You would notice unfamiliar or unusual transactions on your bank statement or credit card statement. These can be a clear indication of identity theft victims. Maybe someone else has gained access to your finance accounts and is misusing them.

Missing emails

If you notice that your important documents and financial statements stop coming into your mailbox, that can be another possible sign that you are facing an identity theft issue. Perhaps the email address in your bank or credit card company has been manipulated.

Unexpected denial of credit

Have you applied for a new loan or credit card, and your application is rejected despite having a good credit history? Maybe some fraudulent activity is affecting your credit score. Someone else may be accessing your credit card credentials.

Frequent calls from debt collectors

Are you receiving calls and letters from the debt collectors? Do the letters show debts that you do not recognize? It is once again a clear indication that personal data has been compromised.

Unfamiliar accounts in your credit report

Have you come across accounts that you do not identify as being a part of your credit cards or credit reports? It may indicate that someone else is using your identity. It is high time you take steps to protect your identity and financial information.

Social Security and IRS notices

Have you been receiving notices from the Social Security Administration or IRS about income from jobs that you are not involved in? It is a sure sign that identity thieves have gained access to your account.

Conclusion

Identity theft can be a very difficult situation anyone would typically come across. It is a highly prevalent threat you would come across quite invariably in today’s digital world. If you have become a victim of an identity theft, it is high time you took the proper preventive measures.

Do remember that tackling an identity theft takes a lot of time. Preventing an identity theft may not always be possible. However, following a few of the tips above should `help you arrive at the best ways to help fight the identity theft. Follow them, and make sure that you are taking adequate steps to avoid the future identity thefts.

Add Comment