Financial technology works with money in all possible ways: management, investing, trading, borrowing, and lending. Some companies, such as banks, stock exchanges, money management, accounting services, and brokers, deal with finances professionally. However, all businesses can improve their corporate finance field by using fintech in their work. With all that, it is more relevant than ever to know how to build a fintech app.

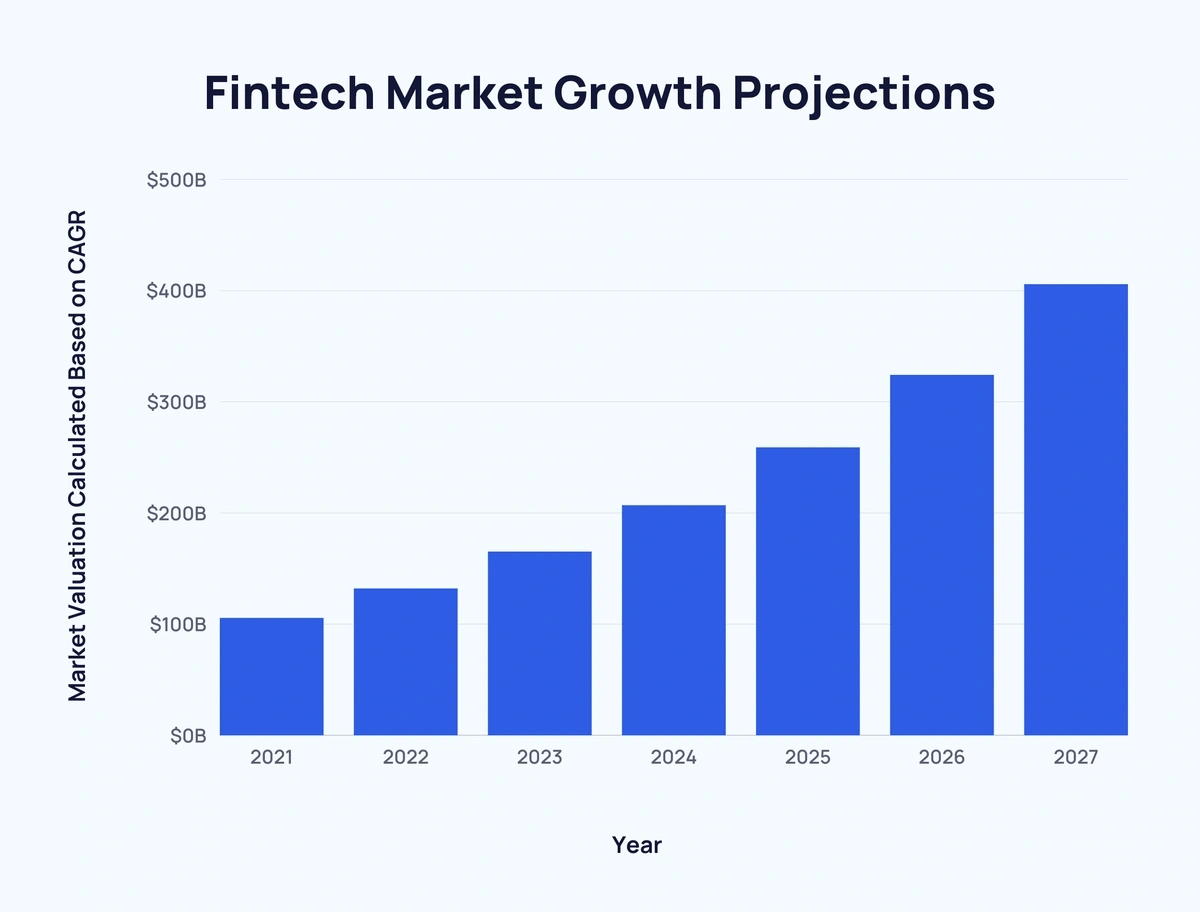

You can become a part of the rapidly growing fintech market, with more than $120 billion now. It is predicted that by 2026 it will reach $324, and in 2030 it will reach almost $700 billion. It is hard to estimate the number clearly, and you’ll see multiple data from various sources. However, we can conclude clearly: it has extreme potential.

A fintech market projected growth in 2021 – 2027 (Source)

A fintech market projected growth in 2021 – 2027 (Source)

An Overview

Companies create fintech apps to deal with money and help their customers with it. There are businesses focused solely on these purposes, and we’ll overview them shortly. However, these functions can be developed in a personal fintech app for any company. As all companies deal with money, fintech benefits your business, no matter where it operates. Money management, exchange, and investing are actual tasks which the application can perform.

First, let’s overview fintech functions and examples to see which can be right for you.

Functions Summary of a Fintech App

Fintech apps have various functions and features, depending on their category and usage. Here, we describe four types: money management, investing, online banking, and insurance.

| Money management | Various tools for personal expenses management, goal setting, and data analytics. They help people manage their funds and use them more rationally and with more benefit. |

| Investing and trading | Almost all large stock exchanges have their applications, which enable users to perform the next functions:

|

| Online banking and money exchange | Almost all large banks in most countries have their own online banking apps. They enable clients to perform banking functions, such as:

|

| Insurance | Many insurance apps started to adopt fintech features, such as AI and data analytics for payment calculation and case analyses, enabling them to provide quick and efficient payments for their clients. |

Successful Fintech Apps Examples

There are many of them with various functions, let’s dive deeper and gather information.

| Cryptocurrency | Coinbas |

A trading platform for cryptocurrency exchange, which provides a simple and elegant UI and opportunities to trade hundreds of cryptocurrencies with a minimum budget. |

| Personal finance | Mint |

A personal finance service with a developed UI and data analytics services. It enables users to set financial goals, monitor expenses, loans, and bills, and connect with financial institutions. |

| Stock exchange | Robinhoon |

A brokerage app for easy stock investing online, with minimum budget and commissions. As for 2023, it is still available only in the United States. |

| Neobank | Revolu |

An example of the fast-growing mobile bank, which uses virtual cards, blockchain technologies for encryption, and data analytics to help clients manage their money. There are other examples of such neobanks in various countries. |

| Payment system | PayPal |

PayPal is One of the first fintech companies in the world. Developed in 1998 to facilitate online money exchange between people in various parts of the world. |

| Insurance | Lemonade |

An insurance app with quick registration and payments in case of problems, which uses artificial intelligence for insurance decisions and calculations. |

Why Do You Need a Fintech App?

If you have a business, you constantly work with money. As you can see, fintech apps can improve this work, helping you to manage incomes, expenses, transfers, investments, and make data-driven decisions. You can calculate by yourself how much time and money can be saved by implementing these functions in your work. A fintech app will become your best friend in the business, constantly improving with you.

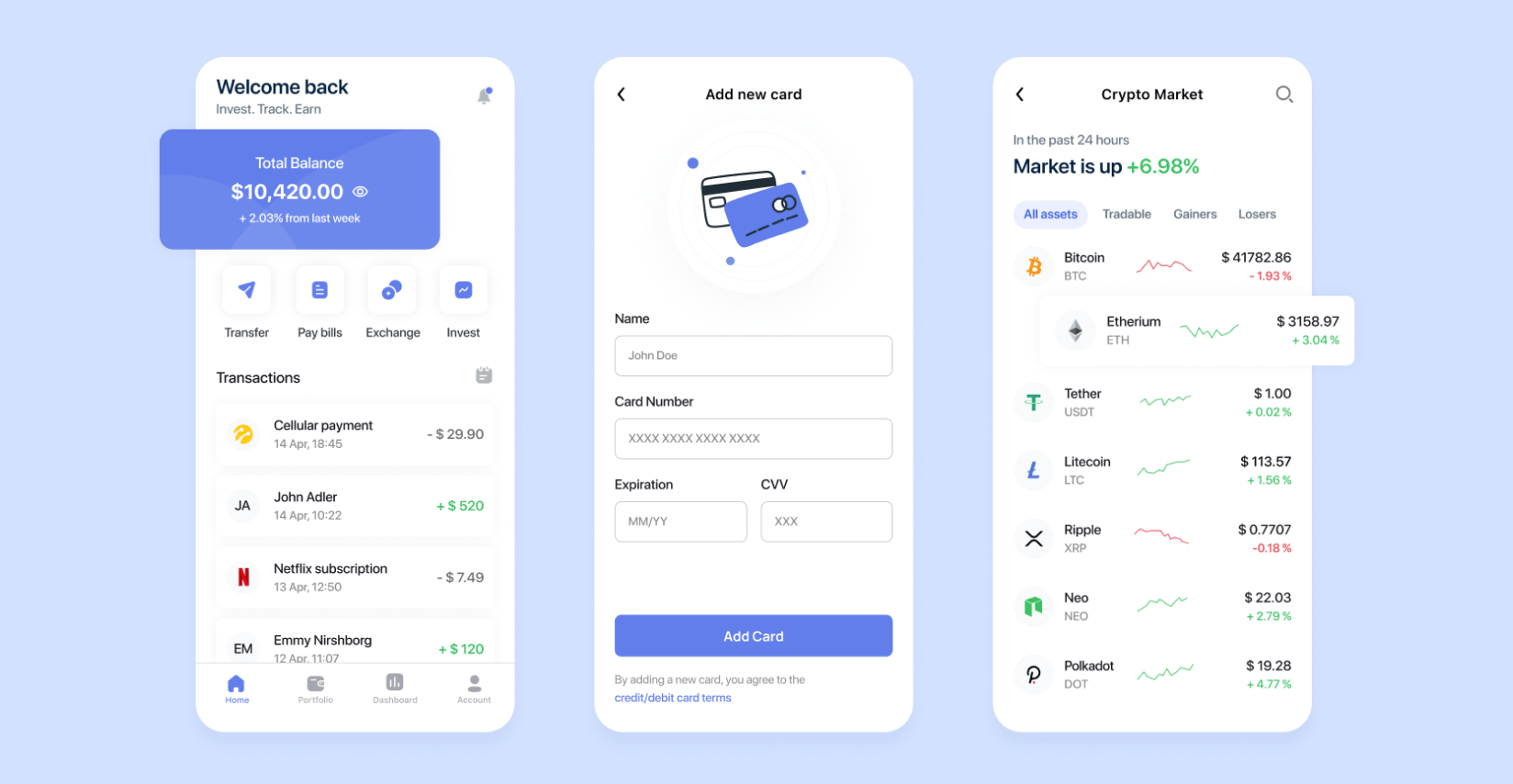

Fintech app concepts for personal or corporate finance management (Source)

Fintech app concepts for personal or corporate finance management (Source)

Let’s see how exactly they can help and how much it will cost to build it.

Fintech App Development Summary

As you can now see the functions and purposes of a fintech app, let’s overview how they can be realized. Fintech is actively growing due to the active implementation of new technologies, such as AI, blockchain, data analytics, and cloud computing. All of them are described below, with source links and a summary.

Artificial intelligence has many applications, such as chatbots which can consult you and make decisions based on your financial data. Blockchain cryptographic technologies are used for security, ensuring that no one can use your money except you. Big data analytics makes your expenses smart and easy to manage, helping you spend money rationally and know all your business activities. Last, cloud computing improves all other app functions; using cloud servers: your app will work quicker and with more security. The table below provides the app development summary with all mentioned options.

| User interface and experience (UI+UX) | The basis of any application: a clear and concise UI that enables one to see their money information and make decisions. |

| Artificial intelligence (AI) | AI tools are used for consulting as chatbots, to facilitate decision-making processes, and make them data-driven |

| Blockchain | It is used for payment security enhancement |

| Data Analytics | Incomes and expenses can be analyzed, classified, and presented in a |

| Cloud computing | Using remote servers |

Cost Summary of a Fintech App

To evaluate the costs you’ll need for your fintech app, firstly estimate a workforce cost for a given region. For example, the app development cost in the United States will be much larger than in Asian countries: $150 – 350 thousand against $70 – 100 thousand. A developer from the U.S. or France will probably charge at least $35-50 for an hour, while one from India will be happy with $15-20. You need to decide which platform the app should operate and which functions are necessary, creating a list of them.

Therefore, three main factors will influence the cost of your app:

- A region where the app will be developed and operated: North America and Western Europe are the most expensive, while Asia and Africa are the least.

- App complexity and options which should be implemented (AI, cloud computing, etc.): the more of them you need, the more hours you need to allocate to the development, and thus the more expensive the app will be.

- A platform on which it will operate: Android is slightly cheaper than iOS, and a hybrid function is the most expensive but the most beneficial.

Conclusion

Your business finance can be managed better using fintech options, such as AI, data analytics, cloud computing, and blockchain. They make money operations easier, faster, and more secure, saving time, expenses, and nerves. Their functions include expense management, financial data analytics, AI-driven decision-making, and improved transaction security by blockchain encryption. You can explore the app examples we presented, evaluate which functions are necessary for your business, and estimate the cost of this app. Then, compare the app costs and benefits it will give you, such as money management automatization, to decide whether you need it.

Add Comment