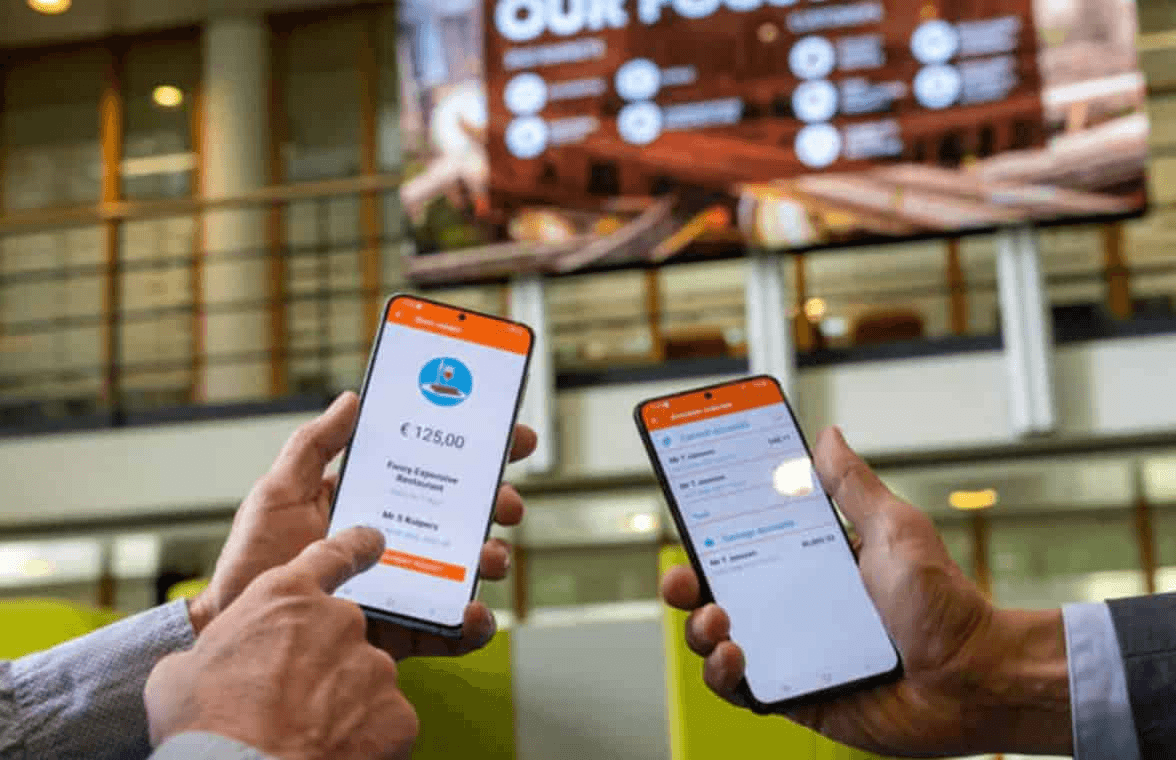

When you make a payment known as peer-to-peer, you are making a financial transaction involving money being transferred from one person to another. When this service is utilized it can involve many different methods to transfer money. P2P transactions are used by many individuals, however, you may not know exactly what they are and the way they work. Today, we will take a closer look at the peer2peer transaction.

What Peer-to-Peer Transfer Payments Are?

Often referred to as p2p, a peer-to-peer payment is a transfer of money between two individuals on a personal level.

A transaction using the p2p method involves expenses such as rent, expense sharing, or when money is sent to loved ones for no specific reason.

A good example of a peer-to-peer service is PayPal, where the money in the wallet can be sent to another PayPal user with just their email address. The money can be transferred instantly to allow for fast access. As compared to its competitors, PayPal is recognized globally and one of the most used P2P payment systems in the world.

The Way Peer-to-Peer Works

An advantage of the peer-to-peer method is its ease of use. The sign-up is short and sweet and involves verification of identity so that a bank account can be connected for deposits and withdrawals.

Before an account can begin to make deposits and withdrawals, the p2p wallet will make trial deposits that must be verified. Depending on your bank policies, the depositing of funds occurring through p2p may be instant or may take a day to process. When the payment is received instantly, the funds can be used right away for purchases.

In order to request or send money, the contact will only need to be selected from their contacts. Once a payment is received, the receiver will get a notification of the transaction.

Quite a few P2P methods available today provide the ability to request a payment from another person. This would take place when a loan is involved between two individuals or when a restaurant bill is split among friends or to remind a person of a payment that needs to be paid.

Besides the common transfers that occur with P2P, there may be transfers occurring through a peer-to-business (P2B) transaction. With these, they will usually call for authentication from the payment platform.

What is the Cost of making a P2P Payment?

Source: Nfcw

When you use a P2P method to send or receive money, you may or may not incur a fee. Any fee will be determined if the sender has the fee included in the amount or if the sender will pay the fee separately. If the fee is part of the total amount to be sent, then the receiver will have the fee deducted from the amount they receive. If your amount includes the fee, then you can expect as much as a 3% fee in order for you to receive it.

How Fast Are Payments Posted through P2P?

The notification that you obtain will be sent at the same time that funds are deposited into your account. The only time that a transfer will take more time is when you have funds withdrawn and sent to your linked bank account. When this withdrawal is made, the funds will normally be in your bank account the following business day. Depending on your bank account, your withdrawal may be ready in your bank within an hour of your withdrawal request. Keep in mind that an instant withdrawal and transfer may incur a processing fee.

How Safe Are P2P Transactions?

Whether you use a P2P method or have one developed by Yalantis, you need to ensure that it remains as safe as possible. That way you can avoid fraud and be scammed.

While a P2P wallet is quite safe, there are a few things that you can do to keep it much safer:

Conduct business with trusted sources.

Avoid P2P transactions with those you do not know. When you have a bad feeling about a transaction, avoid it at all costs.

Keep your P2P wallet secured with a PIN

Beyond a normal password, you may have the option to create a PIN to access your account. If it is an option, then you should take advantage of it.

Obtain transaction notices

When a transaction is made, make sure that it comes with an invoice. That way you will know what transactions are legitimate and which can be flagged.

Ensure recipient personal information is correct

You want to make sure that the recipient name and identifying details are correct before sending money. If you have any questions, be sure to ask them to verify their details.

Advantages and Disadvantages of P2P

- Your P2P method is able to provide invoices concerning sent and received funds

- A P2P platform can be easily developed

- P2P is a cost-effective method to have money sent and received

- Immediate availability of funds

- Fees may be as high as 3%

- Service availability may be limited

- Best used for personal transactions

Conclusion

Having P2P provides a great amount of convenience. However, they may seem limited. Regardless, having a solution that is comprehensive such as P2P will enable you to enjoy sending money when you need to without any worry.

Add Comment